Coco

Rotating while Russian!

- Messages

- 19,493

You're right, HIRSPs are no longer a thing since 2014. They can't charge more based on health and they don't take assets into account, just taxable income. Here is what they count: https://www.healthcare.gov/income-and-household-information/income/

The person I help with their ACA plan just had some unfortunate timing with a huge increase in costs after their hospitalization, so I was left with that impression. Their income is pension and Social Security, $2600/month. This year, to get a plan with an out of pocket under $5,000 and prescription coverage is $190/month.

Even if MLR wasn't working, she may have had income streams that would have counted as income for ACA purposes. It's not a given that her premiums would have gone down.

Here is a calculator on the IRS website:

https://www.taxpayeradvocate.irs.gov/estimator/premiumtaxcreditchange/

As for medicaid, according to this:

www.healthinsurance.org

www.healthinsurance.org

I wonder if she ever pursued disability. It would be a hard sell since her public image is based on fitness. It would tarnish her reputation if it came out, even if she recovered and got off disability.

Hoda is probably playing the long game. She doesn't get any points for being harsh on MLR. But she did get it out there that MLR WASN'T on life support as her daughters had said in their gofundme.

I still don't they they are grifting, though. I think they are just ignorant and overwhelmed.

The person I help with their ACA plan just had some unfortunate timing with a huge increase in costs after their hospitalization, so I was left with that impression. Their income is pension and Social Security, $2600/month. This year, to get a plan with an out of pocket under $5,000 and prescription coverage is $190/month.

Even if MLR wasn't working, she may have had income streams that would have counted as income for ACA purposes. It's not a given that her premiums would have gone down.

Here is a calculator on the IRS website:

https://www.taxpayeradvocate.irs.gov/estimator/premiumtaxcreditchange/

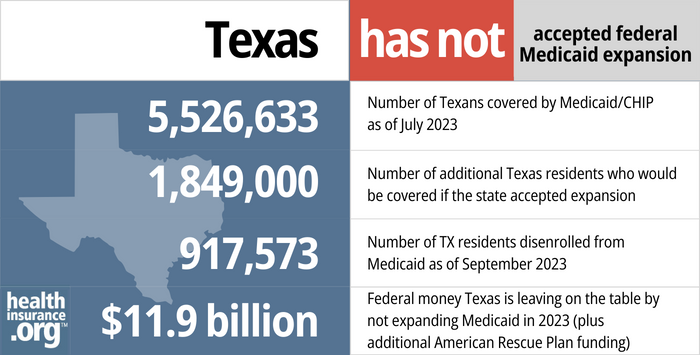

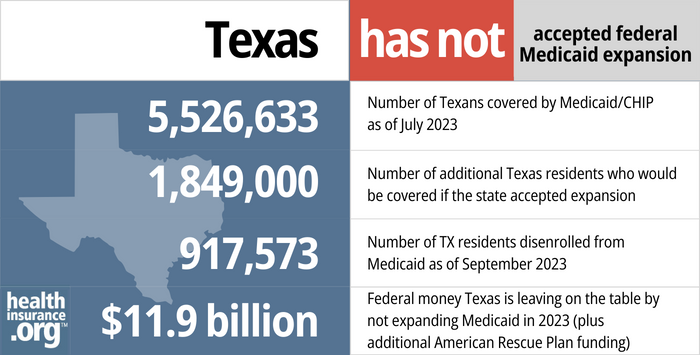

As for medicaid, according to this:

Texas has not expanded Medicaid under the ACA, so adults under 65 who aren’t disabled or raising a child are ineligible for Medicaid regardless of how low their income is.

Medicaid eligibility and enrollment in Texas | healthinsurance.org

Texas has not expanded Medicaid under the ACA. And they also have the most stringent eligibility guidelines in the country for non-disabled adults. As a result, Texas has the highest uninsured rate and the biggest coverage gap in the country, with at least 759,000 residents — and possibly as...

I wonder if she ever pursued disability. It would be a hard sell since her public image is based on fitness. It would tarnish her reputation if it came out, even if she recovered and got off disability.

Hoda is probably playing the long game. She doesn't get any points for being harsh on MLR. But she did get it out there that MLR WASN'T on life support as her daughters had said in their gofundme.

I still don't they they are grifting, though. I think they are just ignorant and overwhelmed.